The Dollars and Sense Don’t Add Up:

Bond Measures E and H

Santa Cruz City Schools

Synopsis

Bond Measures E and H,

passed in 1998, provided funds for much-needed renovation and modernization of

schools within the Santa Cruz City Schools District. Overall, the Grand Jury

found school site personnel pleased with the work completed at their schools,

and acknowledges the scope and complexity of the construction projects

undertaken in the last eight years. Those projects, however, took longer and

cost more than original estimates, and students are now occupying classrooms

that have not been certified by the Division of the State Architect as being in

compliance with all Code of Regulations, Title 24 provisions for structural,

life/fire safety, and ADA projects.

The Grand Jury discovered that Measure E bonds

were sold for more than the voter-approved $28 million, and questions remain

about the 2005 bond refinancing. The Grand Jury is concerned that: bond money

was spent on district administrative offices; lease revenues generated from

sites that were renovated using bond funds went into the Santa Cruz City

Schools general fund; bond funds and property tax deposits have earned and will

continue to earn interest that could be used to reduce bond debt; and promises to

keep the public well-informed about the bond projects have not been kept.

Definitions

ADA: Americans with

Disabilities Act

Alternate: an optional component of a construction

project

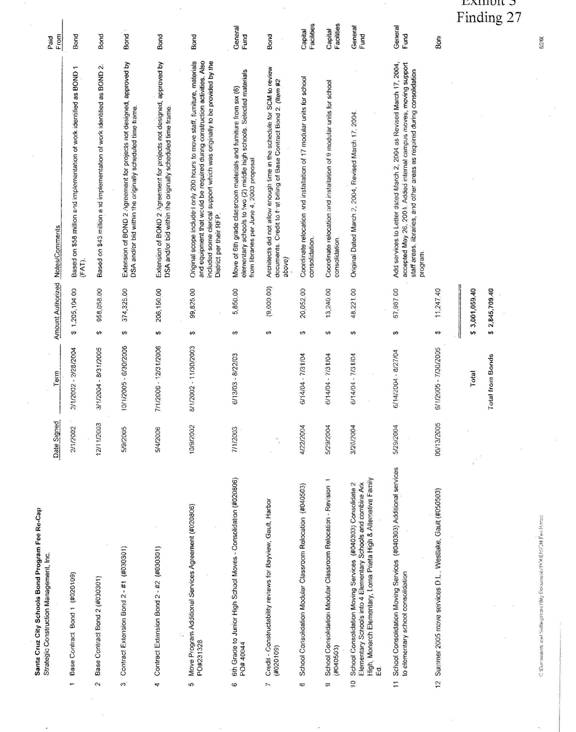

BAN: Bond

Anticipation Note; a note issued in anticipation of later issuance of bonds,

usually payable from the proceeds of the sale of the bonds anticipated

BOC: Santa Cruz

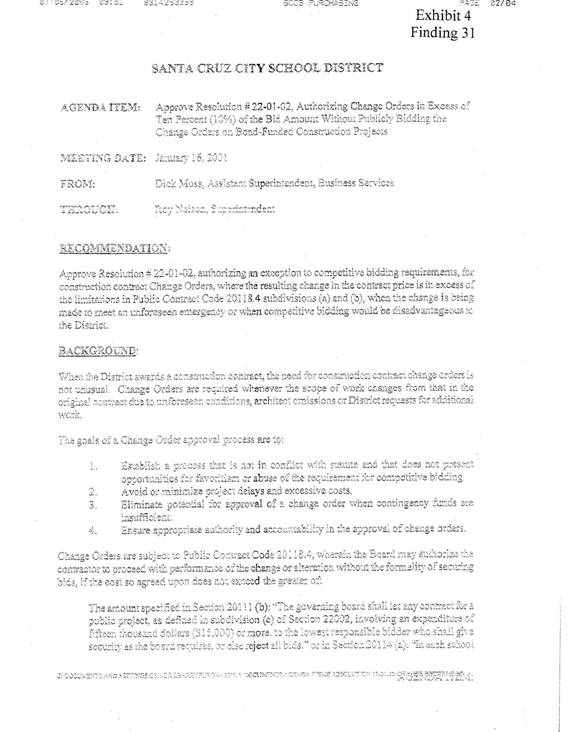

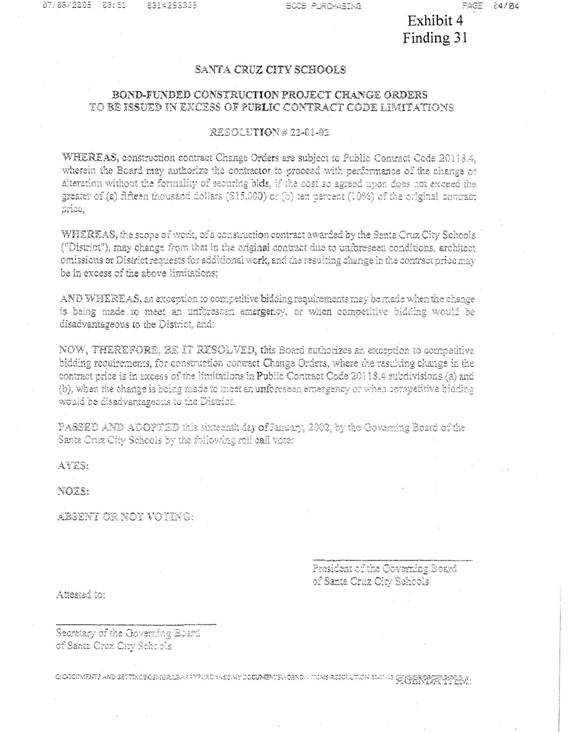

City Schools Bond Oversight Committee

California Code of

Regulations (CCR), Title 24: also known as the California Building

Standards Code. Public school construction in California is governed by these

building standards.

Change Order: a

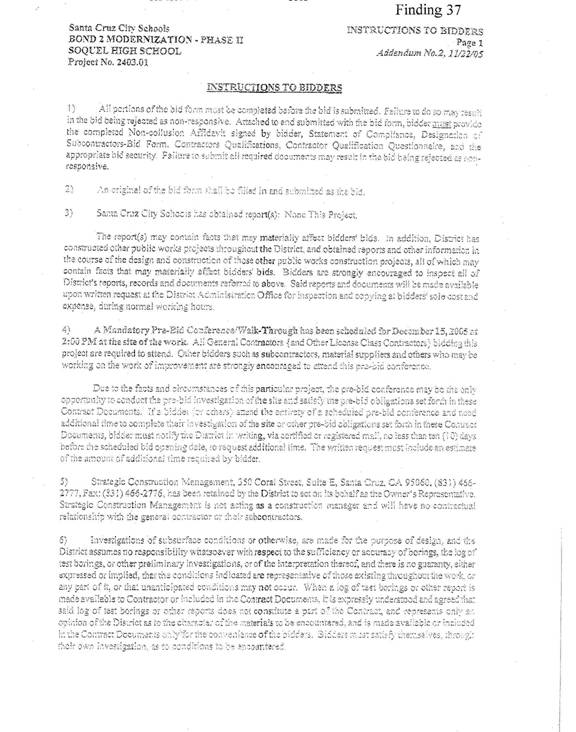

written order that modifies the plans, specifications, or price of a signed

construction contract agreement. Change orders can be initiated for a variety

of reasons, including unforeseen conditions, owner-requested changes, design

errors or omissions, contractor error, and weather-related problems during

construction.

DSA:

Division of the State Architect

DSA

Form-5: the official DSA form that

details the project inspector’s qualifications

IOR: Inspector of

Record; a state-certified inspector that performs state-mandated site

inspection services for public school construction and who is hired and paid by

the owner (school district)

Multiple-prime

contracting: the owner (school district) holds separate contracts with

contractors of various disciplines (such as general, mechanical, electrical).

The owner, or its construction manager, manages the overall schedule and budget

during the entire construction phase.

RFP: Request for Proposal;

an invitation to bid, or a proposal inviting bids from possible suppliers of a

product or service

SB50: the 1998

state bond measure that provided matching funds to the Santa Cruz City Schools

District for modernization projects. District matching funds were generated

from Bond Measures E and H.

SCCS:

Santa Cruz City Schools

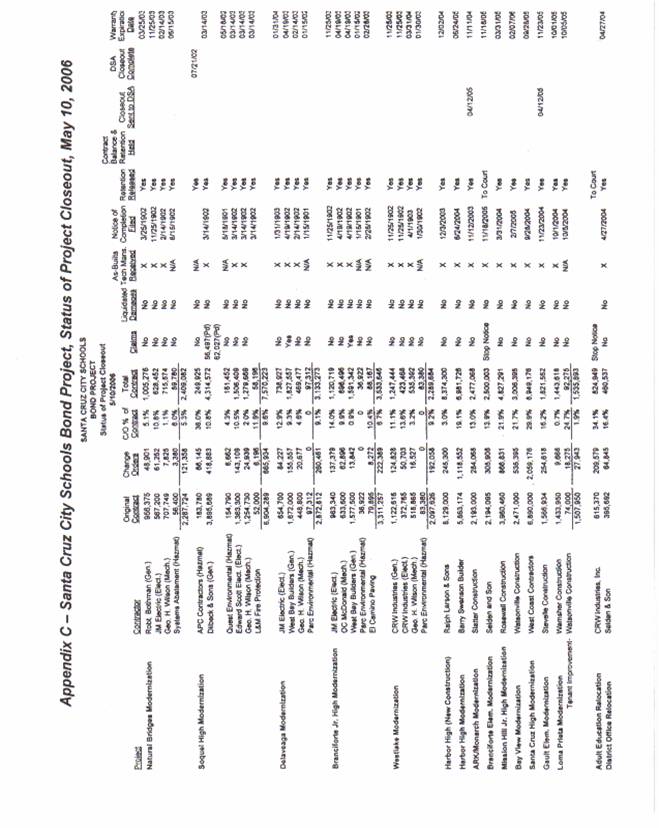

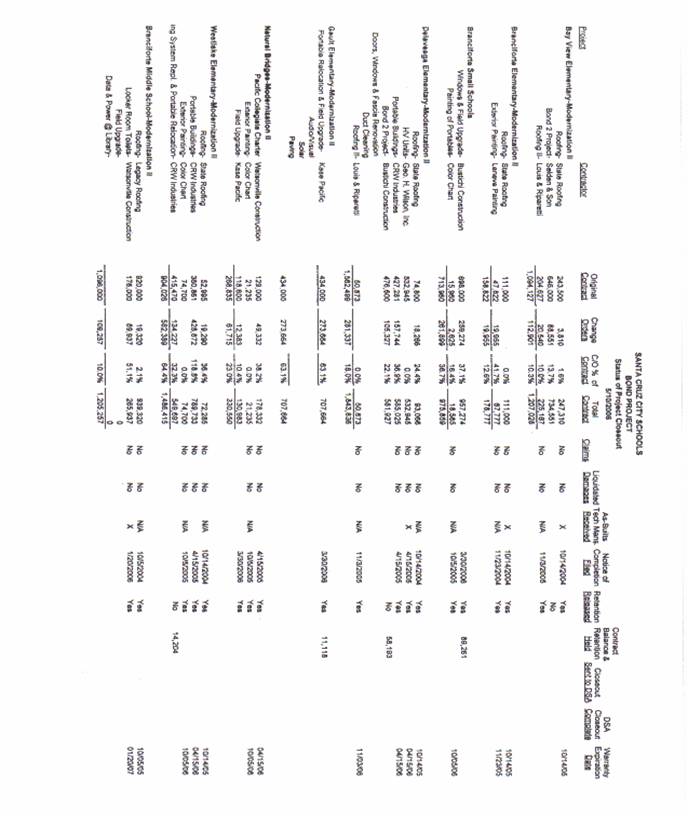

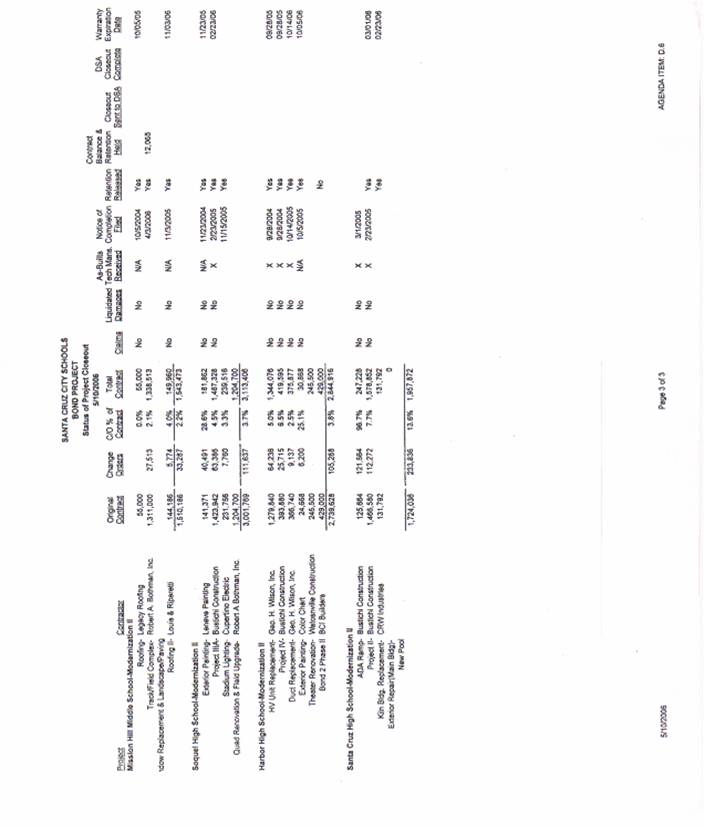

SCCS Bond Project,

Status of Project Closeout, May 10, 2006: This was the version of the summary document detailing construction

costs, change orders, and project completion dates that the Grand Jury used for

this report.

Stop Notice: a notice to withhold payment from a

contractor and to set money aside to satisfy a claim

Background

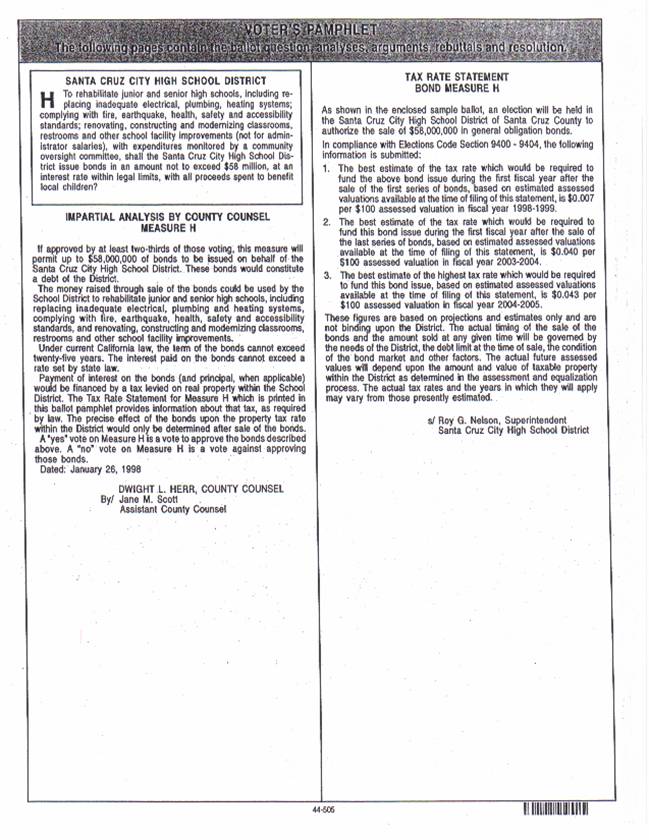

Bond Measures E and H

In April 1998, voters in the Santa Cruz City

Schools (SCCS) District passed two bond measures worth a total of $86 million.

The district spent over $300,000 for this special election for Measure E and

Measure H that was held just seven weeks prior to the regularly scheduled June

primary election.

Measure E, approved by seventy-nine percent

(79%) of the voters, was for elementary school improvements not to exceed $28

million, and Measure H, approved by seventy-four percent (74%) of the voters,

was for junior and senior high school improvements not to exceed $58 million.

The measures stated that the bond money would be used to rehabilitate the

schools, including replacing inadequate electrical, plumbing, heating, and

window systems; to comply with fire, earthquake, health, safety, and

accessibility standards; and to renovate, construct, and modernize classrooms,

restrooms, and other school facility improvements. Bond money would not be used

for administrator salaries. Expenditures would be monitored by a community bond

oversight committee, with all proceeds spent to benefit district schools. All

elementary and secondary school sites in the district were included in the bond

measures.

Voter Information Pamphlet arguments in favor of

Measures E and H stated that “By law, absolutely none of the funds raised by

these ballot measures can be used for administrative salaries, offices, or

operating expenses. All of the funds raised by these measures will stay in our

local community and will be used to fix our schools.”

Bond Details

The E and H bonds were originally each sold in three series:

A, B, and C. Series A was sold in 1998, Series B in 2000, and Series C in 200l. According

to the Voter Information Pamphlet, “Impartial Analysis by County Counsel,” the

term for each bond sale was to be 25 years, which was the maximum term under

California law when the measures were passed. On April 13, 2005, the SCCS Board

of Education passed resolutions authorizing the refinancing of the general

obligation Bond Measures E and H, Series A and B to take advantage of decreased

interest rates. This refinancing did not require voter approval.

As each series was sold, the money from the sale

was deposited into the Santa Cruz County Treasury to be withdrawn by the Santa

Cruz City Schools District as needed for the bond projects. As property taxes

are collected, they are also deposited in the County Treasury. These funds are

withdrawn to make payments to the bond holders.

The Santa Cruz County Assessor’s Office

establishes the rate that each property owner in the Santa Cruz City Schools

District must pay toward the bonds. For the tax year 2005-2006, the rate is:

- Series

A and B, Elementary .035%

- Series

A and B, High School .033%

- Series

C, Elementary .007%

- Series

C, High School .006%

- TOTAL .081%

At this rate, taxes resulting from Bond Measures E and H on

property within the City of Santa Cruz with an assessed value of $300,000 would

be $243 for the 2005-2006 tax year. Property owners

outside the city limits, but within the high school district, would pay only

the high school percentage, or .039%.

Additional Funding

The school renovation projects were not funded solely by the

proceeds of bonds E and H sales. Under the State Construction Program, the

district applied in 1999 for SB50 (State Bond 50) funds for modernization that

it began receiving in July 2000. These state funds were earmarked for

renovation of schools that met the age requirement for modernization

(twenty-five years or older). This was a cash-matching program, and E and H

funds were used for the match. The district received over $28 million from the

state. Additions including bond interest, developer fees, deferred maintenance

funds, and donations brought the total revenue for bond projects to

$128,683,715 as of April 30, 2006. Total revenue for the bond projects is

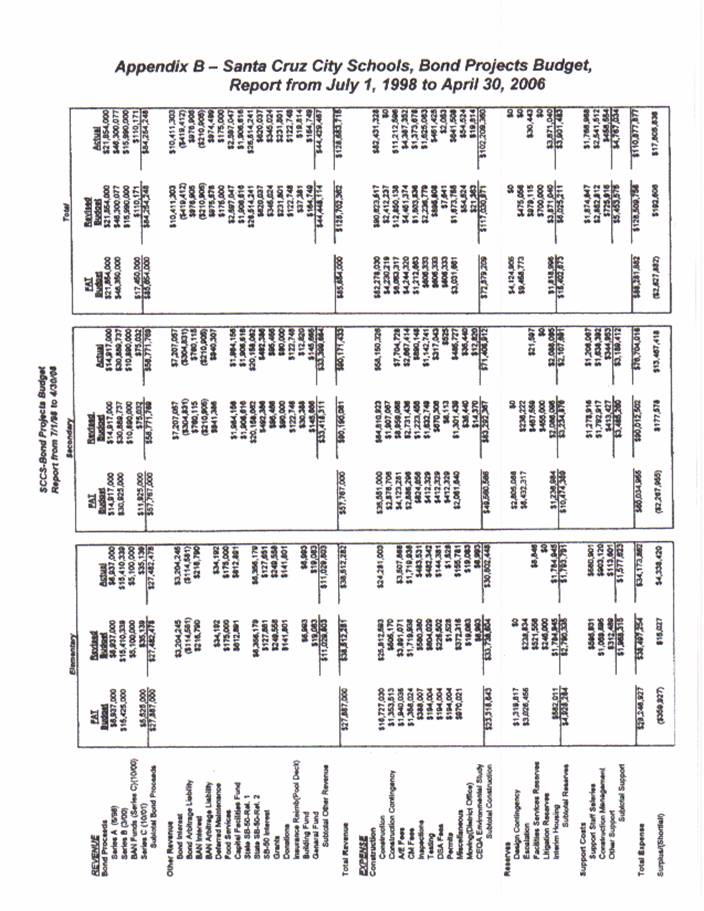

summarized as follows:

|

REVENUE SOURCE

|

REVENUE AMOUNT

|

|

Bond Proceeds

|

|

|

Series A (6/98)

|

$21,854,000

|

|

Series B (3/00)

|

$46,300,077

|

|

BAN Funds (Series C, 10/00)

|

$15,990,000

|

|

Series C (10/01)

|

$110,171

|

|

Subtotal Bond Proceeds

|

$84,254,248

|

|

Other Revenue

|

|

|

Bond

Interest

|

$10,411,303

|

|

Bond Arbitrage Liability

|

($419,412)

|

|

BAN Interest

|

$976,905

|

|

BAN Arbitrage Liability

|

($210,905)

|

|

Deferred Maintenance

|

$974,499

|

|

Food Services

|

$175,000

|

|

Capital

Facilities Fund

|

$2,597,047

|

|

State SB-50 Rel. 1

|

$1,906,616

|

|

State

SB-50 Rel. 2

|

$26,514,241

|

|

SB-50

Interest

|

$620,037

|

|

Grants

|

$345,024

|

|

Donations

|

$231,801

|

|

Insurance

Reimb (Pool Deck)

|

$122,748

|

|

Building

Fund

|

$19,814

|

|

General

Fund

|

$164,749

|

|

Subtotal Other Revenue

|

$44,429,467

|

|

TOTAL REVENUE

|

$128,683,715

|

Table 1. Revenue, SCCS Bond Projects

Budget, July 1, 1998 to

April 30, 2006.

Setting Priorities/Determining Projects

Prior to the bond campaign, a Facility Assessment Team

comprised of construction professionals and district staff evaluated each of

the school sites, worked with site and district staff in developing a needs

assessment, prioritized each site’s needs, and developed a cost estimate for

needed and desired school construction projects. This facilities audit, along

with community input, was used by the district to determine the amount of money

that was requested in the bond election. Although approximately $130 million in

needed and desired improvements were identified, a community survey indicated

voters would be willing to support bonds totaling $86 million. Projects were

prioritized based on the $86 million figure, and renovations and repairs

addressing code requirements, health and safety concerns, and systems projects

such as roofing, electrical, and plumbing were given priority.

After the election, district staff, together with architects

and construction managers, developed a Master Schedule to accomplish the

Facility Assessment projects. The schedule defined the sequence for planning

and construction of the projects at each school site from June 1999 through

December 2003. The schedule was discussed with all site principals and the Bond

Oversight Committee. Within the Master Schedule, each school site was listed

along with an anticipated planning and construction timeline. The work at each

school site was divided into the following tasks: pre-design, design, state

review, bidding, and construction.

In the “Road to Renovation” pamphlet mailed out by SCCS in May

2000 to residents within the SCCS boundaries, it was stated that the

construction schedule called for all projects to be completed by the end of the

2003-2004 school year. Due to state funding and additional revenues, in May

2003, with SCCS Board approval, site planning committees began meeting to

identify and prioritize additional modernization projects at each school site.

As of June 2006, there are still three projects to be bid, and eighteen

projects under construction. Projects may extend well beyond the end of 2006.

Project Management

Bond projects were originally overseen by the Director of Bond

Projects, a district administrative position, to provide general oversight and

management of the program. Two architect/construction management teams (DES-WLC

Architects/Turner Construction Management for the elementary schools, and

Beverly Prior/Kitchell Construction Management for

the secondary schools) assisted. Projects were put out to bid for multiple

prime contractors, that is, a prime contractor for each trade. Due to the

difficulty in managing multiple and separate contracts, missed work, and

instances of poor work quality, the district discontinued its use of multiple

prime contractors.

The bond projects are now managed by district staff and

contracted firms. The organizational components for project management include:

·

the Assistant Superintendent, Business Services,

providing district administration oversight;

·

general contractors bidding for projects;

·

a construction management firm providing overall

program management for bond projects (Strategic Construction Management);

·

two architecture firms, one for the elementary

and junior high schools (DES Architects), and one for the high schools (Beverly

Prior Architects), providing design services and project administration;

·

Inspectors of Record providing state-mandated

site inspection services; and

·

district employees (3.2

positions) paid by bond funds: a full-time district Construction Project

Coordinator, a full-time clerical support person; a full-time accounting

person; and support from the district purchasing manager for bidding and

contracting processes.

Bidding

In California, public school construction is governed by the

California Public Contract Code. Construction contracts must be awarded to the

lowest responsible bidder as defined in these code sections:

“Responsible

bidder,” as used in this part, means a bidder who has demonstrated the

attribute of trustworthiness, as well as quality, fitness, capacity, and

experience to satisfactorily perform the public works contract. (Section 1103)

On

the day named in the public notice, the department shall publicly open the

sealed bids and award the contracts to the lowest responsible bidders. (Section

10180)

SCCS District officials stated that the lowest, responsive,

responsible bidder is hired by the district. A responsive bidder is one that

has provided all necessary documents and meets all specified qualifications in

a timely manner.

When construction projects are put out to bid, a Request for

Proposal (RFP) is published in the newspaper, and interested contractors are

invited to submit bids by a specified date. On that date, the bids are publicly

opened, recorded, and awarded to the lowest, responsive, responsible bidder.

Division of the State Architect Oversight

The Division of the State Architect (DSA) reviews all

public school construction involving structural, fire/life safety, and ADA

compliance projects. Construction plans and documents drafted by the district’s

hired architects and engineers are submitted to the DSA for plan checking to

make sure they conform to the California Code of Regulations, Title 24. After

plans are checked and approved, they are stamped with an identification stamp,

and are ready for the construction phase. When a project is under construction,

it is supervised by DSA field operations. Field engineers go to the site to

make sure plans are being followed and work is up to code. The field engineer

receives reports from state-certified Inspectors of Record (IOR) at least twice

a month. The IORs make sure work is performed

according to the DSA-approved documents. Public school construction is not

inspected by city and county building inspectors, but by state-certified

inspectors.

Once a project is completed, a Notice of Completion is

recorded at the County Recorder’s office and is publicized. The project

closeout process then begins. The DSA reviews all required project

documentation to verify that all work was performed and inspected in accordance

with code requirements. If documentation indicates that construction met these

requirements, the DSA issues a Letter of Certification to the school district.

If documentation is incomplete, the DSA sends the Architect of Record a letter,

with a ninety-day deadline to submit all remaining documents. If these

documents are not submitted, the project is closed without DSA certification.

The file can be reopened when documentation is complete, but a fee of $150 for

each project is assessed.

Bond Oversight Committee

In Fall 1998, a committee consisting

of volunteer community members was formed by the district to provide oversight

for the bond projects. The Bond Oversight Committee (BOC) is an advisory body

only and makes recommendations to the school board. Final authority for all

aspects of the bond measures resides with the SCCS Board of Trustees. The BOC

meets every other month and receives reports on financial and construction

status; reviews standard bid documents and change orders; reviews contracts for

design, construction management, construction contractors, and contract

amendments; and has been involved in the reallocation of dollars between school

sites. Specified roles and responsibilities include attending all committee

meetings; becoming familiar with the laws, regulations, and processes that the

school district must satisfy in completing the projects authorized by the bond;

and working with all interested parties to facilitate communication about the

status of the bond projects.

According to district officials, by the end of Summer 2006,

ninety-eight percent (98%) of the bond funds will have been spent as projects

are nearing completion. The BOC’s final meeting is scheduled for November 2006.

A subcommittee has been established to work with school district staff and

Strategic Construction Management to prepare a final report on the bond projects

for the board and community members, detailing how both time and money were

spent under Measures E and H.

Scope

This investigation was undertaken to review financial

documentation for the Santa Cruz City Schools Bond Measures E and H. The

investigation included:

- reviewing

SCCS Board of Education minutes, Bond Oversight Committee minutes, site

summaries, project completion documents, and financial documents

pertaining to Bond Measures E and H;

- reviewing

web sites, newspaper articles;

- conducting

interviews with district staff and volunteers; and

- visiting school sites to view bond project results.

As the investigation progressed, the bond details and issues

of project management, bidding, and oversight were also examined.

Sources

Interviewed:

Santa Cruz City Schools

District personnel.

Bond Oversight Committee members.

Division of the State

Architect personnel.

Santa Cruz County

personnel.

Reviewed:

Memoranda/Reports/Minutes/Agendas:

Advantages/Disadvantages

of Using Multiple Prime v. Single General Contractor, agenda packet, Bond

Oversight Committee meeting, January 27, 2000.

California

Department of General Services, Division of the State Architect, Project

Inspector Qualification Record, DSA-5, revised March 27, 2003.

Communications

Matrix for Bond Projects Participants, November 29, 2001.

IOR Bi-Monthly Progress Reports, Santa Cruz

High, May 2002.

Memo from Northcross, Hill and Ach, June 8, 2006.

Official Statements, Santa Cruz City Elementary

School District, General Obligation Bonds, Election of 1998, Series A, B, and

C.

Official

Statements, Santa Cruz City High School District, General Obligation Bonds,

Election of 1998, Series A, B, and C.

Official

Statement, Santa Cruz City Elementary School District, 2005 General Obligation

Refunding Bonds.

Official

Statement, Santa Cruz City High School District, 2005 General Obligation

Refunding Bonds.

Santa Cruz

City Schools, Agreement for Consultant Services, Construction Program

Management Services, Strategic Construction Management, February 1, 2002.

Santa Cruz

City Schools, Board of Education for the Elementary and Secondary Districts

Minutes, May 12, 1999 to May 10, 2006. [Please see Appendix for specific

dates.]

Santa Cruz

City School Bond Oversight Committee Meeting Minutes, May 16, 1998 to May 18,

2006. [Please see Appendix for specific dates.]

Santa Cruz City Schools “Bond Oversight

Committee Roles and Responsibilities,” revised April 17, 2002.

Santa Cruz City Schools Bond Project, Status

of Project Closeout, May 10, 2006.

Santa Cruz City Schools, Bond Projects

Budget, Report from July 1, 1998 to April 30, 2006.

Santa Cruz City Schools District Bond

Projects Status Reports, November 17, 1999 to January 25, 2006. [Please see

Appendix for specific dates.]

Santa Cruz City Schools, Request for

Proposals, Management Services for Construction Projects, undated.

Soquel High

School Bond II Modernization Project IIIA, Bid #2004-21, Opened June 3, 2004.

Soquel High School Bond 2 Phase II Rebid, Bid #2006-09, Opened December 22, 2005.

Newspaper Articles/Pamphlets:

Contra

Costa Times, “Schools’ refinancing questioned,” April 30, 2006.

County of

Santa Cruz Sample Ballot and Voter Information Pamphlet for Special School

District Election, Tuesday, April 14, 1998.

“Road to

Renovation: Keeping You Informed,” Santa Cruz City Schools, undated.

Santa Cruz

Sentinel:

“Bond-funded school repairs set to

start in Santa Cruz,” May 13, 1999.

“Bonds

making a difference,” March 22, 2001.

“Branciforte remodeling project

disappoints staff,” October 14, 2001.

“Error could cost schools thousands,”

April 8, 2005.

“Firm will oversee school construction

projects,” February 15, 2002.

“Moving costs stir school-bond debate,”

May 29, 2003.

“Santa Cruz City Schools finds surplus

in general fund,” April 20, 2006.

“Students say last goodbye to Natural

Bridges, Branciforte schools,” June 12, 2004.

Web sites:

Building

Standards Commission, http://www.bsc.ca.gov.

California

Code of Regulations, http://www.bsc.ca.gov/title_24/documents/part1/2001_part1.pdf.

California

Education Code, http://caselaw.lp.findlaw.com/cacodes/edc/15200-15205.html.

California State

Constitution, http://www.leginfo.ca.gov/const.html.

California

Public Contract Code, http://www.aroundthecapitol.com/code/contents.html?sec=pcc.

“Choosing the

Best Delivery Method for Your Facility Projects,” http://www.mbpce.com/news_pubs_delivery.html.

Division of the State Architect, http://www.dsa.dgs.ca.gov.

Division of

the State Architect On-Line Project Tracking System, http://www.applications.dgs.ca.gov/dsa/etrackerweb/DistrictProject.asp?clientid=44-h2

and http://www.applications.dgs.ca.gov/dsa/etrackerweb/DistrictProject.asp?clientid=44-42.

General

Obligation Bonds, http://www.calschools.com/static/GOBond.htm.

Santa Cruz

City Schools, http://www.sccs.santacruz.k12.ca.us.

Santa Cruz

City Schools, Bond Projects, http://www.sccs.santacruz.k12.ca.us/bizservices/BondProject/bondproject.htm

(this web site is no longer accessible).

Santa Cruz

County Office of Education, http://www.santacruz.k12.ca.us/board/index.html.

Santa Cruz Sentinel, http://www.santacruzsentinel.com.

State

Education Oversight Commissions, http://www.ecs.org/clearinghouse/57/86/5786.htm.

Strategic

Construction Management, http://strategic-cm.com/main/santacruzcityschools.htm.

TBW&B,

Public Finance Strategies, LLC, http://www.tbwb.com/clients.htm.

2001

California Building Standards Administrative Code, California Code of

Regulations, Title 24, Part 1, http://www.bsc.ca.gov/title_24/documents/Part1/2001_part1.pdf.

Visited:

Ten

Santa Cruz City School sites.

Findings

Bonds E and H

1.

The E and H bonds were originally each sold in three

series: A, B, and C:

|

Bond Sold

|

Date

|

Bond Amount

|

Bond Term Ends

|

|

Series A, Elementary

|

July 1, 1998

|

$7,000,000.00

|

August 1, 2027

|

|

Series B, Elementary

|

March 1, 2000

|

$15,500,000.00

|

August 1, 2029

|

|

Series C, Elementary

|

October 2001

|

$5,598,115.65

|

February 1, 2026

|

|

TOTAL ELEM.

|

|

$28,098,115.65

|

|

|

Series A, High School

|

July 1, 1998

|

$15,000,000.00

|

August 1, 2027

|

|

Series B, High School

|

March 1, 2000

|

$31,000,000.00

|

August 1, 2029

|

|

Series C, High School

|

October 2001

|

$11,997,433.50

|

February 1, 2026

|

|

TOTAL HIGH SCH.

|

|

$57,997,433.50

|

|

In April 2005, Series A and B Elementary and High School

bonds were refinanced:

|

Refinance, Series A and B, Elementary

|

April 2005

|

$22,785,000

|

August 1, 2029

|

|

Refinance, Series A and B, High School

|

April 2005

|

$45,500,000

|

August 1, 2029

|

Table 2. Santa Cruz City Schools Bond

Sales, Measures E and H.

2.

Total Elementary bond sales, Series A, B, and C

exceeded the $28 million dollar cap established in Bond Measure E.

Response: Santa Cruz County Auditor-Controller AGREES.

Response: Santa Cruz City Schools AGREES.

3.

When asked about exceeding the $28 million cap on the

Elementary bonds, district administrative staff referred the Grand Jury’s

questions to the district’s bond financial advisor, Northcross,

Hill and Ach. The Grand Jury was told, “Unintentionally, $98,115.65 was issued

in bonds over the 28 million dollar amount approved by the voters. The district

has made provision to repay the $98,115.65 and all interest that has accrued.”

The amount of the interest earned is unknown to the Grand Jury.

Response: Santa Cruz County Auditor-Controller AGREES.

Response: Santa Cruz City Schools AGREES.

Initial drafts of the bond authorization for the Santa Cruz

City Elementary School District (County of Santa Cruz, California) General

Obligation Bonds, Election of 1998, proposed a maximum authorization of $28.1

million. When adopted, the resolution authorizing the bonds provided for a

maximum of $28 million (the additional $100,000 amount was inadvertently

omitted). It was assumed, upon the issuance of each series, that the authorized

amount was $28.1 million. Upon issuance of the Series C Bonds, the $28 million

limit was exceeded by $98,115.65. This fact was discovered in early June 2006.

On June 16, 2006, the total sum of $114,325.65, $98,115.65 from the District

(representing unexpended proceeds of the Series C Bonds), $8,105.00 from the

District’s financial advisor and $8,105.00 from the District’s bond counsel,

was deposited with the paying agent and invested in U.S. Treasury Securities and

held for the payment of the Series C Bonds. The amounts paid by the District’s

financial advisor and by the District’s bond counsel represents the total

amount paid by the taxpayers and will be used to reimburse those amounts

collected by the District for such payment.

4.

The last of the original Elementary bonds was sold in

2001, but repayment of the $98,115.65 overage has not yet been made as of June

10, 2006.

Response: Santa Cruz County Auditor-Controller AGREES.

School District staff advised the County Auditor-Controller

that the $98,115.65 overage has been returned to the District’s third party

bond paying agent on June 16, 2006, who will repay this amount at the next call

date. The Auditor-Controller has not verified

this information.

Response: Santa Cruz City Schools PARTIALLY

AGREES.

The $98,115.65 overage was repaid on 6/16/06.

5.

When Elementary and High School Bonds, Series A and B

were refinanced in April 2005, the total amount of the refunding bonds was

$4,280,000 higher than the remaining principal of the original Series A and B

bonds. The Elementary Series A and B Bonds were refinanced for $22,785,000 (the

outstanding principal was $21,030,000); the High School Series A and B Bonds

were refinanced for $45,500,000 (the outstanding principal was $42,975,000).

Response: Santa Cruz County Auditor-Controller

AGREES.

Response: Santa Cruz City Schools AGREES.

6.

SCCS District’s bond financial advisor stated

that “the amount of the refunding bonds is determined by the amount needed to

establish an escrow to pay off the old bonds, which includes interest and

principal due . . . and pay the costs of issuance.”

Response: Santa Cruz County

Auditor-Controller AGREES.

The Santa Cruz County Auditor-Controller does

not know whether the District’s financial advisor made this statement, but

generally speaking, this is how the amount of refunding bonds are determined.

Response: Santa Cruz City Schools AGREES.

7.

Elementary bonds, Series C and Elementary 2005

Refunding Bonds total $28,383,115.65, again exceeding the $28 million cap

established by the bond measure.

Response: Santa Cruz County

Auditor-Controller PARTIALLY AGREES.

The elementary bonds,

Series C and Elementary 2005 refunding bonds do total $28,383,115.65. Whether

this exceeded the $28 million cap established by the bond measure is a legal

matter which the Auditor-Controller is not qualified to determine.

Response: Santa Cruz City Schools PARTIALLY

AGREES.

The issuance of refunding bonds, where the

refunding bonds bear interest at a lower rate than the refunded bonds, always

will require a higher amount of refunding bonds than refunded bonds. This is

because federal tax law limits the investment rate of the escrow created to pay

the refunded bonds to the interest rate on refunding bonds. Therefore, more

dollars are needed, at a lower rate, to pay fewer dollars at a higher rate.

This is common practice for general obligation refunding bonds. California law

specifically permits the refunding bonds to have a principal amount greater

than the bonds refunded.

Government

Code Section. 53552.

Whenever the legislative body of a local agency determines that prudent

management of the fiscal affairs of the local agency requires that it issue

refunding bonds under the provisions of this article, it may do so without

submitting the question of the issuance of the refunding bonds to a vote of the

qualified electors of the local agency . . . .

Refunding bonds shall not be issued if the total net interest cost to

maturity on the refunding bonds plus the principal amount of the refunding

bonds exceeds the total net interest cost to maturity on the bonds to be

refunded plus the principal amount of the bonds to be refunded . . . . Subject

to this limitation, the principal amount

of the refunding bonds may be more than, less than, or the same as the principal amount of the bonds to be

refunded. (emphasis added)

In all cases, the total net interest cost to

maturity on the refunding bonds plus the principal amount of the refunding

bonds is less than the total net interest cost to maturity on the bonds

refunded plus the principal amount of the bonds refunded.

8.

The April 2005 refinancing of the Elementary and High

School Bonds, Series A and B is not detailed on the

SCCS Bond Projects Budget, Report from July 1, 1998 to April 30, 2006.

Response:

Santa Cruz County Auditor-Controller DISAGREES.

School

District staff advised the Auditor-Controller that this is not an accurate

finding, but the Auditor-Controller has not verified this information. The

Auditor-Controller has no opinion.

Response: Santa Cruz City Schools DISAGREES.

The SCCS Bond

Projects Budget Report is designed to report on the status of revenue received

and available for expenditure on the construction projects and related support

costs, and the status of expenditures made from those funds. The April 2005 refinancing of the Elementary

and High School Series A and B Bonds do not appear in this budget report

because the refinancing did not result in any additional funds available to be

expended on the construction projects.

9.

According to the Official Statements for the bond

sales, property owners residing in the Santa Cruz City Schools District will be

repaying bonds E and H until 2029.

Response: Santa Cruz County Auditor-Controller

AGREES.

Response: Santa Cruz City Schools AGREES.

10. The

Voter Information Pamphlet for Bond Measures E and H contained an “impartial

analysis by County Counsel” stating that “under current California law, the

term of the bonds cannot exceed twenty-five years.”

This term is also stated in the California Education Code, Section 15144: “The

number of years the whole or any part of the bonds are to run shall not exceed

25 years, from the date of the bonds or the date of any series thereof.”

Response:

Santa Cruz County Auditor-Controller PARTIALLY AGREES.

The

voter information pamphlet did include this statement. California Education

Code Section 15144 authorizes bonds up to 25 years. California Government Code

authorizes bonds up to 40 years. Whether the 29 year bonds that were issued

under the Government Code are legally compliant for a School District is a

legal matter which the Auditor-Controller is not qualified to determine.

Response: Santa Cruz City Schools PARTIALLY

AGREES.

The bonds were authorized by resolution adopted

by the Governing Board, with the following stipulations:

Said bonds proposed to be

issued and sold shall bear interest at a rate not exceeding the maximum rate

allowable by law, at the time or times of the sale thereof, such interest to be

payable annually or semiannually thereafter, and the number of years the whole

or any part of the principal amount of the bonds shall be payable shall not

exceed twenty-five (25) years (or such

greater maximum term as may be permitted by law) from the date of the bonds

or the date of any series thereof. (emphasis added)

Section 53506 of the California Government Code

provides full authority for the issuance of bonds by a school district and is

intended to provide a complete additional and alternative method for doing so,

supplemental and additional to the powers conferred by any other laws. This

section authorizes the issuance of bonds for up to 40 years.

The School

District has no control over the analysis of ballot measures written by the

County Counsel, who did not mention the authority that school districts have

under the Government Code to issue general obligation bonds for terms up to 40

years. The terms on Series A and B of

Measures E and H were 28 years.

11. On

April 13, 2005, the SCCS Board of Education passed resolutions authorizing the

refinancing (refunding) of the general obligation Bond Measures E and H, Series

A and B to take advantage of decreased interest rates.

Response:

Santa Cruz County Auditor-Controller AGREES.

School

District staff advised the Auditor-Controller that this is an accurate finding,

but the Auditor-Controller has not verified this information.

Response:

Santa Cruz City Schools AGREES.

12. SCCS

District’s bond financial advisor stated that the refunding of the bonds will

result in lower debt service payments, with the majority of savings in

2006-2010, and that the refinancing will lower taxes.

Response:

Santa Cruz County Auditor-Controller PARTIALLY AGREES.

The Santa Cruz County Auditor-Controller does

not know whether the District’s financial advisor made this statement, but law

requires any debt refinancings to result in lower

annual debt service payments. The debt

service payments for the Santa Cruz City Schools Series A and B bonds were

reduced after the refinancing. Debt

service payments for A and B totaled $4,714,087 in FY 2004-05 before the

refinancing. Debt service payments were

reduced to $4,439,449 in FY 2005-06 and $4,010,865 in FY 2006-07 after

refinancing. Following is a schedule detailing

this.

|

|

|

2004-05

|

2005-06

|

2006-07

|

|

Elementary Schools

|

|

|

|

|

|

A (1998)

|

466,655

|

|

|

|

|

B (1998)

|

1,083,070

|

|

|

|

|

A and B Total

|

1,549,725

|

|

|

|

|

A and B

Refinanced (2005)

|

1,453,347

|

1,319,610

|

|

|

|

|

|

|

|

|

C (1998)

|

400,000

|

400,000

|

405,001

|

|

|

|

|

|

|

|

|

Total

|

1,949,725

|

1,853,347

|

1,724,611

|

|

|

|

|

|

|

|

High School

|

|

|

|

|

|

A (1998)

|

1,002,470

|

|

|

|

|

B (1998)

|

2,161,892

|

|

|

|

|

A and B Total

|

3,164,362

|

|

|

|

|

A and B

Refinanced (2005)

|

2,986,102

|

2,691,255

|

|

|

|

|

|

|

|

|

C (1998)

|

855,000

|

855,000

|

855,751

|

|

|

|

|

|

|

|

|

Total

|

4,019,362

|

3,841,102

|

3,547,006

|

|

|

|

|

|

|

|

Total Elementary and High Schools

|

|

|

|

|

A (1998)

|

1,469,125

|

|

|

|

|

B (1998)

|

3,244,962

|

|

|

|

|

A and B Total

|

4,714,087

|

|

|

|

|

A and B

Refinanced (2005)

|

4,439,449

|

4,010,865

|

|

|

|

|

|

|

|

|

C (1998)

|

1,255,000

|

1,255,000

|

1,260,752

|

|

|

|

|

|

|

|

|

Total

|

5,969,087

|

5,694,449

|

5,271,617

|

Debt service for the refinancing bonds (A and B) will continue at approximately

$4 million until FY 2010-11, at which time it will increase to about $4.7

million, where it will remain until the bonds mature in 2029.

Response: Santa Cruz City Schools PARTIALLY

AGREES.

The

taxpayers for both the elementary school district and the high school district

will see significantly lower tax rate on the bills they receive during the fall

of 2006. These bills will be for the fiscal year 2006-07. The timing of the savings is consistent with

the statement referenced above.

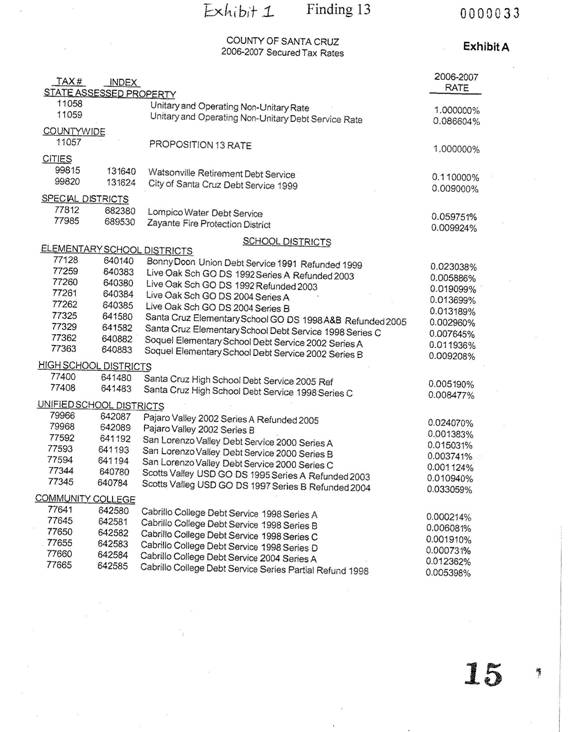

13. For

tax year 2004-2005, property owners residing in the Santa Cruz City Schools

District within the City of Santa Cruz were paying property taxes at a rate of

.068% toward bonds E and H. In tax year 2005-2006, the rate increased to .081%.

Response:

Santa Cruz County Auditor-Controller AGREES.

These

property tax rates are stated correctly.

However, these rates include the Series C bonds which were not

refunded. The property tax rates for

just the Series A and B bonds (excluding the Series C bonds) were .054% for FY

2004-05 and .068% for FY 2005-2006.

There was a one time increase in the tax rates for FY 2005-06, but it

was followed by a significant decrease to .008% for FY 2006-07. The primary

reason for the one time rate increase in FY 2005-06 is because taxes are

collected in the previous fiscal year to make the August debt service payment

in the following fiscal year, further complicated by the mechanisms of the bond

refinancing and the associated reserve funds during this period. The much lower rate in FY 2006-07 compensates

for the higher rate the previous year.

In the future, the property tax rates to pay this debt service will

stabilize at below the pre-refunding rate of .054%, tracking with the total

debt service payments indicated in item 12 above.

Response: Santa Cruz City Schools PARTIALLY

AGREES.

The tax

rate is calculated by the County of Santa Cruz. The primary considerations are

the debt service on the bonds, the reserve factor established by the county and

the assessed value. Of the three factors

the district can control only the debt service on the bonds. The High

School refunding resulted in $2.5 million in total debt service savings and the

Elementary School refunding resulted in $1.2 million in total debt service

savings. In the tax year 2005-06 the

combined refundings resulted in 6,393.99 of debt

service savings. In 2006-07 the combined

tax rate on the E and H bonds is .024272% (see Exhibit 1).

14. Interest

earned on bond sale proceeds has been used for the bond projects and has not

been used to repay the bond.

Response:

Santa Cruz County Auditor-Controller AGREES.

School

District staff advised the Auditor-Controller that this is an accurate finding,

but the Auditor-Controller has not verified this information. This is a legally acceptable and common

practice.

Response:

Santa Cruz City Schools AGREES.

15. As

property tax is collected to repay bonds E and H, the money is deposited in the

pooled investment fund of the county until the district draws it out. These

deposits earn interest.

Response:

Santa Cruz County Auditor-Controller PARTIALLY AGREES

As

property tax is collected to repay bonds E and H, the money is deposited in the

County’s pooled investment fund.

However, the District does not draw the funds out of the County. Rather, the County makes the debt service

payments directly to the Bond Paying Agent.

Response: Santa Cruz City Schools PARTIALLY

AGREES.

The District does not draw the funds out of the County

pooled investment fund. The County

transfers the funds directly to the Bond Paying Agent, who uses the funds to

make interest payments to Bond holders and to retire Bonds as they come due.

Budget Expense Summary

16. Following

is a summary of the SCCS Bond Projects Budget expenses from July 1, 1998 to

April 30, 2006:

|

ITEM

|

EXPENSE

|

PERCENTAGE OF EXPENSES

|

|

Construction Contracts

|

$82,431,328

|

74%

|

|

Architects/Engineers

|

$11,212,596

|

10%

|

|

Construction Management

|

$6,928,864

|

6%

|

|

Miscellaneous Construction Costs

|

$4,178,084

|

4%

|

|

Reserves

|

$3,901,483

|

4%

|

|

Staff Salaries and Other Support

|

$2,225,522

|

2%

|

|

TOTAL EXPENSES

|

$110,877,877

|

100%

|

Table 3. Summary of SCCS Bond Projects

Budget Expenses, July 1, 1998 to

April 30, 2006.

Project Management

17. In

January 2001, the Bond Projects staff requested authority from the school board

and the BOC to use their discretion before bidding projects in the future, and

to decide whether to bid projects with one general contractor or use

multiple-prime contractors.

18. Results

of the first four major bond projects undertaken at one high school, one junior

high school and two elementary were described as follows: “All four projects

were completed late, two of the four projects are over budget, the quality of

some of the work was sub-standard on two projects, and sub-standard work was

allowed to stand when first done, assuming it would be rectified as part of the

punch list at the end of the projects, but after many spaces had been

reoccupied. Some work that was planned to be included in some projects was left

out of the initial plans and specs and had to be added with change orders,

adding time and cost to the project.”

19. At

the October 24, 2001, SCCS Board of Education meeting, district administrative

staff dissatisfaction with the ability of the construction managers to monitor

and control the work on multiple prime projects was reported. District staff

recommended:

·

bidding future construction projects using

general contractors

·

terminating the two elementary and secondary

Construction Managers’ contracts

·

increasing Inspector of Record time on projects

to better monitor quality of work

·

increasing architect involvement in construction

administration

·

reorganizing district support and oversight of

projects

·

pre-qualifying bidders for future projects

Response: Santa Cruz City Schools AGREES.

20. District

administrative staff stated that using general contractors had the advantages

of less contract administration, total coverage of work, and direct lines of

accountability. Disadvantages were that the general contractor might not select

the lowest subcontractor bid and could charge up to a fifteen percent markup on

subcontractor change orders.

District administrative staff stated that using general contractors could cost

more, but there would be clear lines of responsibility and “headaches would be

reduced.”

Response: Santa Cruz City Schools

PARTIALLY AGREES.

District administrative staff also believed that bidding

projects with General Contractors instead of multiple-prime contractors would

reduce legal costs. The District has

been involved in two construction lawsuits, both with contractors on

multiple-prime projects and none with general contractors. The clear lines of responsibility and

accountability for any construction issues are with the general contractor. When multiple-prime contractors are on a

project, the lines of responsibility and accountability can become blurred

between prime contractors.

21. On

November 15, 2001, district administrative staff reported to the BOC that the

SCCS Board had approved a plan to hire a consultant to provide general

oversight and management of the construction program. The board’s preference

was to hire professionals in the construction management field to manage future

projects, instead of having district employees in the project management role.

The board stated that it did not have confidence that district employees could

provide management, in light of the problems that had been reported by school

staff at Branciforte Junior High on that school’s projects.

22. Seven

firms responded to the district’s Request for Proposal (RFP) for a construction

program manager. Three finalists were interviewed, and Strategic Construction

Management was chosen by the SCCS Board as the Construction Program Manager to

be effective February 1, 2002. District administrative staff and volunteers

stated the board liked the fact that Strategic Construction Management was

local and had ties to the community.

23. The

district has not been able to produce the fixed-price bids and requested

supporting documentation for this selection process. This documentation is

public record.

Response: Santa Cruz City Schools

PARTIALLY AGREES.

The selection of a CM firm was not a bid process. It was a Request for Proposals for selecting

professional services, for which the public bid requirements

do not apply. Four CM firms were

interviewed by the BOC Interview Committee, who ranked them as follows:

1.

Strategic CM

2.

BMR

3.

Zahn

4.

3DI

Based on hand-written notes taken by Dick Moss at the

1/17/02 BOC meeting, the fee proposals from the three firms recommended to the

Board were:

1.

Strategic CM $1,195,104,

travel @ $.365/mi. for miles greater than 100 per day, $.08/copy, reimbursables at cost +15%.

2.

BMR $1,334,000,

reimbursables at cost +10%, in-district mileage

included in base fee

3.

Zahn $2,133,930

The proposals from the CM firms were discarded when the

District Office moved from 2931 Mission Street to Soquel High School in

January, 2004.

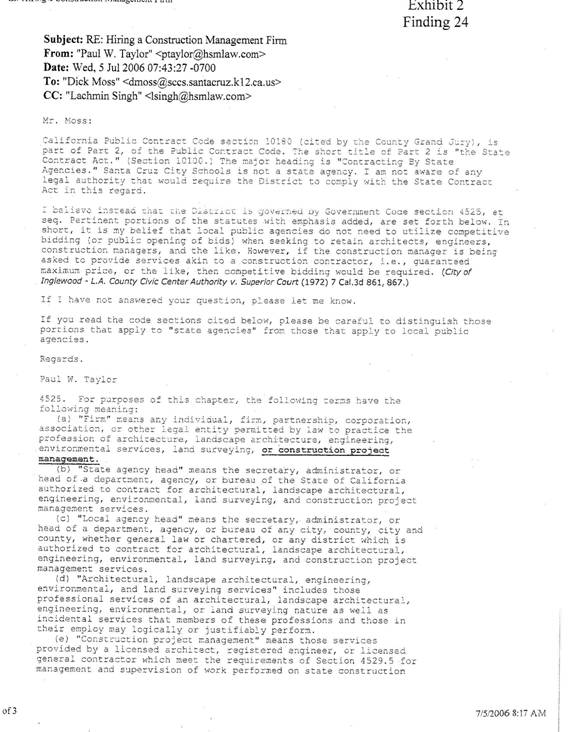

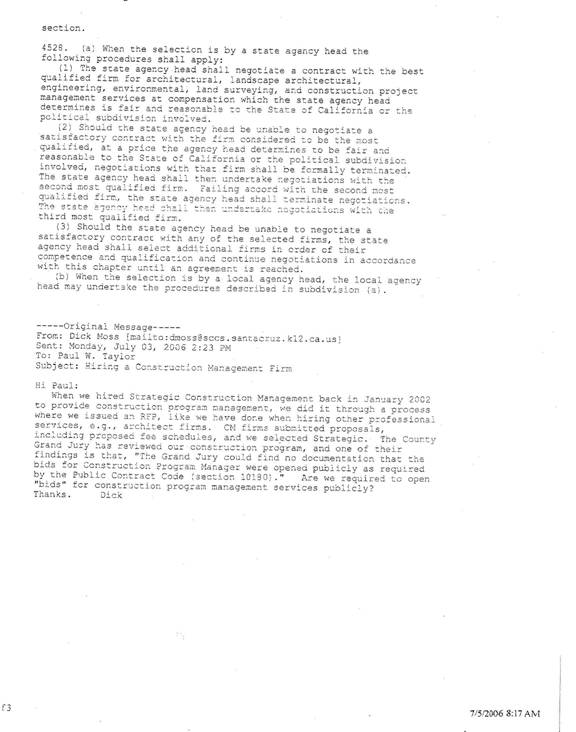

24. The

Grand Jury could find no documentation that the bids for the Construction

Program Manager were opened publicly as required by the Public Contract Code.

Response: Santa Cruz City Schools DISAGREES.

Contracting for construction management services is

contracting for professional services and is not subject to the lowest bid

requirements of the Public Contract code.

The fees for professional services are typically negotiated from a

proposal and are not bid. This process

is the same process used when hiring architects or state-certified

inspectors. According to the District’s legal

counsel on our construction program, Paul Taylor of Hefner, Stark and Marois, the District is not subject to section 10180 of the

Public Contract Code that applies to State agencies but is subject to

Government code section 4525 et seq. (See Exhibit 2.)

25. “Previously,

the district used its staff to oversee multiple contractors at individual

schools. Officials expect the new system, which includes hiring a general

contractor for each project, will simplify the process and attract more bids,

particularly from area contractors. The district will pay Strategic $1.2

million. District officials expect to finish all projects by December 2004.”

26. Construction

Management budgets were reduced by $2,128,663 due to termination of the two

previous Construction Management contracts. Architect Fee budgets were then

increased $1,288,160 for increased services for construction administration due

to reorganization of management for the projects. These adjustments, when

combined with the new Strategic Construction Management contract for $1.2

million, produced an immediate overall increase for the bond projects of over

$360,000.

27. Since

February 1, 2002, there have been numerous contract extensions and additional

payments approved for Strategic Construction Management, summarized as follows:

|

|

Original

Contract

|

Moving

Services

|

Contract

Renewal

|

Contract

Extension

|

Moving

Contract

|

Contract

Extension

|

TOTAL

|

|

Term

|

2/2/02 –

2/28/04

|

8/23/02 –

2/28/04

|

3/1/04 –

8/31/05

|

10/1/05 –

6/30/06

|

5/05 –

9/05

|

7/1/06 –

12/31/06

|

|

|

Amount

|

$1,205,104

|

$99,825

|

$958,058

|

$374,325

|

$27,254

|

$224,500

|

$2,889,066

|

Table 4. Approved Contracts for

Strategic Construction Management Paid by Bond Funds.

Response: Santa Cruz City Schools PARTIALLY

AGREES.

The original contract with Strategic Construction

management was based on the projects originally planned out of the $86 million

in E and H bond funds. The renewal and

subsequent extensions in the SCM contract were added when the District received

an additional $26.5 million in State SB50 funds. The District also added $15 million in other

District funds to the projects that increased the need for Strategic CM

services. Refer to attached spreadsheet

(Exhibit 3).

28. In

addition to bond funds, payments totaling $68,273 to Strategic Construction

Management have been approved by the SCCS Board: $48,221 from the General Fund

to “plan and coordinate moving of furniture, equipment and supplies (March 24,

2004); and $20,052 from the Capital Facilities Fund to “plan and coordinate the

relocation of 21 portable classrooms” (April 21, 2004).

Response: Santa Cruz City Schools PARTIALLY

AGREES.

These services were related to school reorganization and

consolidation and were not paid for with Bond funds (see Exhibit 3).

29. In

the RFP for Management Services for Construction Projects that was part of the

Strategic Construction Management Agreement with the district, one requirement

is to “plan and coordinate the moving of staff, furniture, material and

equipment related to the construction projects.” Strategic Construction

Management submitted a fixed fee proposal to secure this contract.

Response: Santa Cruz City Schools PARTIALLY

AGREES.

Strategic Construction Management’s original scope included

moving as it related to construction projects, such as moving classroom

furniture as part of on-going construction, and moving furniture and equipment

within a given campus as a result of work directly related to the Bond

construction projects. The increase in

services/fees were required for the management and coordination of moves at the

various construction sites beyond those considered in the District’s scope of

services as described in the Request for Proposals (RFP) for management

services for construction projects. The

Strategic Construction Management original fee proposal was based on the

District’s scope of services as described in the RFP. The District’s RFP was not specific regarding

the scope, phasing requirements and amount of time required to coordinate and

direct the moves at the numerous school sites.

Included in Strategic Construction Management’s scope of services and

fixed fee was 200 hours dedicated for planning and coordinating the moving of

staff, furniture, materials and equipment during construction. The allocated fee for this service was

$15,000.

At the time of the request for the fee increase, Strategic

Construction Management had expended approximately 390 hours related to the

moves. Strategic Construction Management

was providing services that included: preparing documents to solicit a minimum

of three (3) moving quotes, leading pre-quotation school site walks, receiving

quotations, developing phasing plans, meeting with staff and faculty to

determine packing needs, arranging for the delivery of cardboard boxes and

storage containers and being available to coordinate and facilitate moves.

In addition to the amount of time needed to support the

District with their moves, Strategic Construction Management had not been

provided with “full-time clerical support” as described in the RFP. Not having this support took Strategic staff

away from the duties they anticipated.

30. In

March 2002, the board approved a district Construction Projects Coordinator

position to serve as a liaison between Strategic Construction Management and

the district sites. The position is funded through the elementary and secondary

bonds. The head of the district Maintenance Department was appointed to the

position.

Bidding

31.

The SCCS Board of

Education approved a resolution to no longer require a public re-bidding of

work once change orders exceeded the cost of the original bid by over ten

percent (10%), as had been previously required. It was stated that the re-bid

process can cause a six- to eight-week delay, and since the district had a

general contractor in charge of bond-funded projects, the chances of exceeding

a ten percent overrun were considerably less.

Response: Santa Cruz City Schools PARTIALLY

DISAGREES.

A copy of Board resolution #22-01-02

authorizing exceeding the 10% limit on change orders and the cover memo that

went to the Board with the resolution, are attached as Exhibit 4. Nowhere in the cover memo does it say that

the chances of exceeding the 10% limit were less because of having a general

contractor in charge of the construction projects, as alleged by the Grand Jury

in this finding.

There were two reasons that the Board

approved the resolution allowing change orders to exceed 10% of the original

bid. They were:

1.

The 10% threshold is reasonable on new construction

projects, but not on modernization projects on older buildings where there is

greater potential for finding problems during construction that need to be

addressed that could not be anticipated during the initial development of the

plans and specs for the project. Most of

our projects were renovation and modernization of older buildings. Most of the change orders were a result of unforeseen

conditions discovered during renovation or from additional work requested by

the District.

2.

Most of the construction projects were being done on

operating school facilities during the school year and were disruptive to

students and staff. If all change orders

that exceeded 10% of the original contract were bid, it would have (a) delayed

the projects, thereby prolonging the disruption of students and staff; and (b)

potentially resulted in delay claims from the original contractor if that

contractor was delayed in their ability to complete their contract waiting for

a second contractor to come in and complete separately bid change order

work. During the spring and summer of

2004, when the elementary and small schools were being reorganized, the timing

of completing the relocation of portables and getting schools ready for the

opening of school at the end of August was critical. If we had bid change orders separately at

that time, the schools would not have been ready for students in time for the

start of school.

When projects encounter unforeseen

conditions, it is never prudent or cost effective to stop the work, determine

the extent of the additional work required to proceed with the original work,

prepare bid documents for public bidding and publish them, conduct job walks

and accept bids. The costs to

investigate and then prepare the bid documents and publish the work would

outweigh the costs of continuing with the original contractor. The time delays of conducting the

investigation and bidding could be at least 5-6 weeks (at a minimum) before

work could commence. The costs for the

original contractor to pull off the job while the new contractor does their

work, and then re-mobilize their staff have not been factored. It makes complete sense to work with the

original contractor and expedite the work with one general contractor

responsible for coordination, payments, warranties, etc.

32.

The SCCS Bond Project, Status of Project Closeout,

May 10, 2006, revealed that out of sixty-nine projects, thirty-seven (or 54%)

exceeded a ten percent cost overrun due to change orders.

Response: Santa Cruz City Schools PARTIALLY

DISAGREES.

Most of the change orders that exceeded 10% of the

original bid were based on additional work requested by the District, or were

due to unforeseen conditions discovered during the construction process. Budget contingency reserves had been

established to cover these costs.

33.

In October 2005,

the SCCS Board voted to become subject to the Uniform Public Construction Cost

Accounting Procedures and to provide for informal bidding procedures under the

Uniform Public Construction Cost Accounting Act Procedures. This allowed

projects from $35,000 to $125,000 to be bid using a pre-approved list of

satisfactory contractors, while projects over $125,000 were subject to formal

bidding procedures. The rationale was that this would allow more flexibility in

the execution of work; speed up bidding procedures; improve timeliness of

project completion; reduce paperwork and expenses related to advertising; and

simplify administration.

34.

The SCCS District

was advised by legal counsel to set a consistent policy for the acceptance of

bids. Subsequently, it was decided to award contracts based on the lowest total

bid on each project. Projects often contain several alternates, which may or

may not be actually included in the final project. The contract, however, is

still awarded on the total bid.

Response: Santa Cruz City Schools PARTIALLY

AGREES.

Legal Counsel advice was based on the

methodology used to define lowest bid in conformance with Public Contract Code.

35.

When projects

contain alternates, contractors can bid low or even zero (0) on some

alternates, thereby lowering their overall total bid.

Response: Santa Cruz City Schools PARTIALLY

DISAGREES.

If a contractor bids low or zero on

the alternates and they have the lowest total bid that is accepted by the

District, they are still obligated to complete the alternates for the amount of

their bid.

36.

In March 2006, the

district awarded a bond project contract to a bidder whose past projects for

the district included a project that had change orders totaling 34.1% of the

original contact amount, a Stop Notice, and had gone to court. That same bidder

had previously completed district bond projects with change orders of 32.3%,

36.9%, and 118.8% of the original contract amounts.

Response: Santa Cruz City Schools PARTIALLY

DISAGREES.

This contractor was CRW Industries,

Inc. The cause of change orders on

previous CRW projects exceeding 10% of the original contract amount was

primarily due to the District requesting additional work and on unforeseen

conditions. The “Stop Notice” that was

filed on CRW was based on employees of a subcontractor filing a lawsuit against

the subcontractor over a pay dispute, and filing the Stop Notice to keep the

District from paying CRW so CRW could not pay the subcontractor until the pay

dispute was resolved with the subcontractor.

The Stop Notice

had nothing to do with any action by CRW.

CRW was the low bidder on the Santa

Cruz High School Kiln Building project at $131,792. The fact that CRW change orders on previous

projects exceeded 10% of the original contract amounts is not legal grounds for

declaring CRW a “not responsible” bidder on future projects.

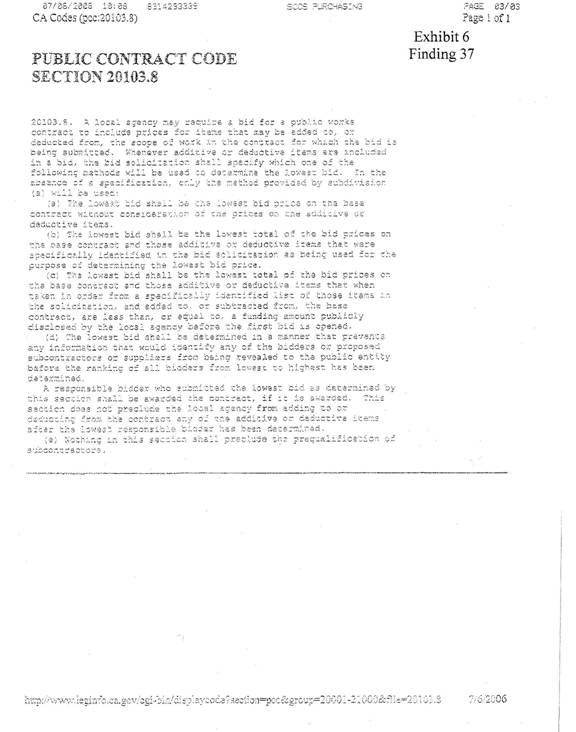

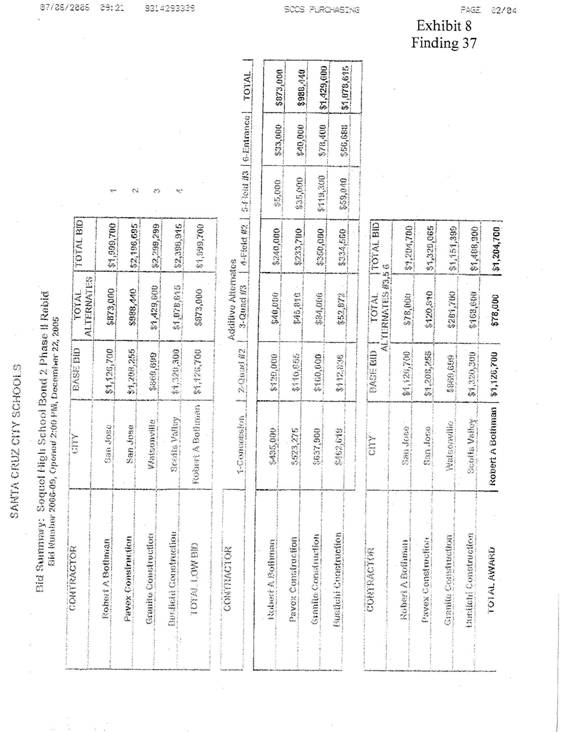

37.

Contracts were not

always awarded to the lowest bidder as evidenced by Bid # 2006-09. The contract

was awarded for $1,204,700 when the lowest bid was actually $1,151,399.

Response: Santa Cruz City Schools PARTIALLY

DISAGREES.

Contracts are always awarded to the

lowest bidder as defined in section 10 of our Instructions to Bidders (Exhibit

5) which are based on Public Contract Code section 20103.8 (Exhibit 6), and

advice from District legal counsel (Exhibit 7).

A copy of bid # 2006-09 (Exhibit 8) shows that, as defined in our bid

documents, Robert Bothman was the low bidder based on

the total bid with all alternates.

Change Orders

38.

The SCCS Bond Project, Status of Project Closeout, May

10, 2006, document does not include all bond projects, notably those undertaken

in 1998-1999. Approximately $4 million worth of projects are not detailed, nor

are their change orders.

Response: Santa Cruz City Schools PARTIALLY

AGREES.

The first projects were done in 1999. They were small projects consisting of

installing new play structures at the elementary schools, resurfacing the

Soquel High School student parking lot, installing an outdoor eating area cover

at Mission Hill, termite eradication at Branciforte

Junior High and installing new gym roofs at Santa Cruz High School and Harbor

High School. Many of these projects were

maintenance projects and did not require Department of the State Architect

approval. The project close-out report

was not started until the first round of major modernization projects were

begun in 2000 and began close-out in 2001.

The small early projects were not added to the report.

39.

The SCCS, Bond Project, Status of Project Closeout, May

10, 2006, showed twenty projects with change orders exceeding twenty percent

(20%) of the original project contract. These percentages range from 21.7% to

118.8%, resulting in additional costs of $5,479,544 above the original contract

amount of $17,779,162 for those twenty projects. This reflected a 30.8%

increase over the original contract amounts.

Response: Santa Cruz City Schools PARTIALLY AGREES.

For all projects listed on the 5/10/06 Status

of Project Close Report, total change order costs were $9,621,580, or 14.1% of

total original contract amounts of $68,468,271.

This is not an unreasonable average change order percentage for

renovation and modernization projects.

As mentioned in the response to Finding # 32, many of these change

orders were generated by District requests for additional work and additional

work required to correct unforeseen conditions.

40.

Sixty-nine completed or nearly-completed projects

detailed on the SCCS, Bond Project, Status of Project Closeout, May 10, 2006,

had change orders totaling $9,621,580, or fourteen and one-half percent (14.5%)

of their original contract total of

$66,457,279.

Response: Santa Cruz City Schools DISAGREES.

See response to finding #39.

41.

District officials stated that general contractors

typically make a fifteen-percent markup on change orders.

Response: Santa Cruz City Schools AGREES.

The General Contractor’s 15% mark-up on change

orders is to cover the General Contractor’s bonds, insurance overhead and

profit, and was specified in the contract documents.

Division of the State Architect Oversight

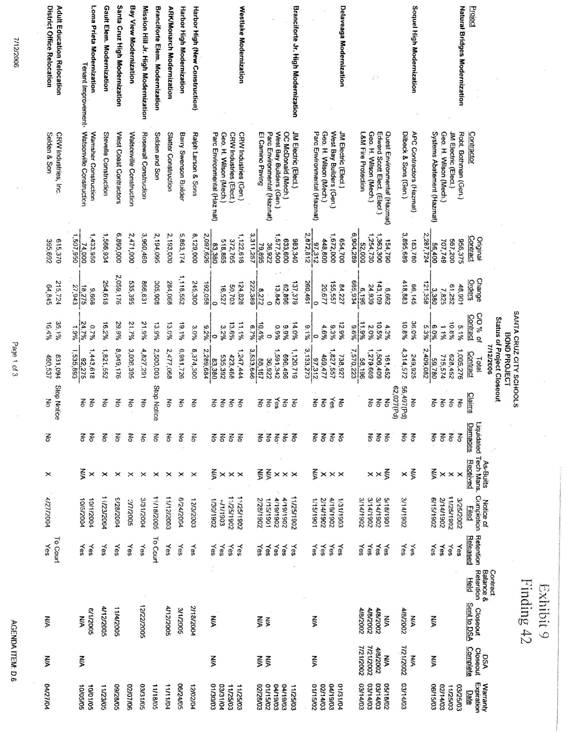

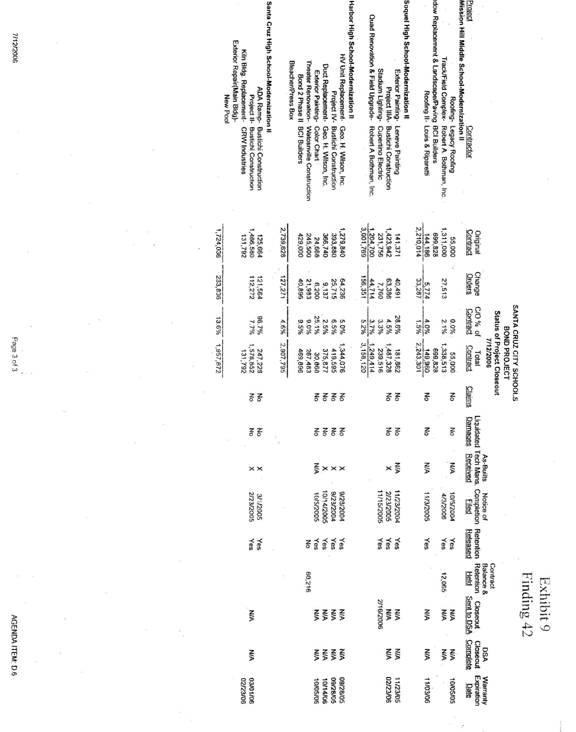

42. According

to the Santa Cruz City Schools, Bond Project, Status of Project Closeout, dated

May 10, 2006, sixty-four projects have had Notices of Completion filed. Of

those sixty-four projects, only one is listed in the “DSA Closeout

Complete” column, and only two are listed in the “Closeout Sent to DSA” column.

The Architect of Record is responsible

for submitting the required closeout documents for final certification.

Response: Santa Cruz City Schools PARTIALLY AGREES.

The Bond Project

Status of Projects Close-Out Report of 7/12/06 (Exhibit 9 attached) indicates

that all project close-out documents have been submitted to DSA on twelve

projects. Eight of the projects listed

are still under construction and not ready for close-out document

submittal. Four projects have final DSA

close-out.

Final DSA close-out

can take from two to five years. Both

architect firms, DES and Beverly Prior, have staff that are actively working on

gathering and completing project close-out documents for submittal to DSA, and

are making regular reports to the District on their status. Close-out documents come from some material

suppliers, from portable classroom manufacturers, and from the IOR Once close-out

documents are received by DSA, it can take DSA staff as long as two years to

complete processing of those documents and closing out of the project files. This is due to understaffing at DSA.

43. The Grand Jury found at least one instance of

a project being started without prior DSA notification by the IOR (DSA Project

Code 01-106000). This appears to be a violation of the Code of Regulations,

Title 24, Part 1, Section 4-331.

Response:

Santa Cruz City Schools DISAGREES.

This was the Soquel High School Ag Facility

relocation project. The IOR’s (Fred Powers) Qualification Record DSA-5 was

submitted to DSA on 9/30/04. It was

approved by DSA on 10/4/04. The Contract

Information form SSS-102 was submitted to DSA on 11/1/04 and indicated that

work would start on 11/1/04. We recall

that work actually started around the first of December. This does not appear to be an accurate

statement.

44. Inspector

of Record assignment date records obtained from the SCCS District and the DSA

do not match.

Response: Santa Cruz City Schools PARTIALLY

DISAGREES.

The District was not provided copies of the

records provided to the Grand Jury by the DSA and therefore cannot comment on

this finding.

45.

“The school board must provide for and require

competent, adequate and continuous inspection by an inspector . . .” and; “The

project inspector . . . must be approved by the DSA for each individual

project.”

46. In reviewing the IOR field reports for Santa

Cruz High Modernization, project number 01-103363, there is a gap of eighteen

days with no IOR reports or notations. One inspector had been terminated on May

2, 2002, and the next IOR report was dated May 20, 2002.

Response: Santa Cruz City Schools:

The Santa Cruz High

School Inspector was released for specified reasons. A second inspector was engaged but replaced

by the DSA Field Engineer. A third

inspector was subsequently replaced by a fourth inspector by the DSA Field

Engineer. Since only demolition was

underway and no structural or fire/life safety work was involved, lapse in

coverage was less stringent. DSA drove

the missing coverages due to their manipulation of

the inspector selection process – no fault of the District.

47. DSA Field Notes from the supervising field

engineer from July 10, 2002, stated the first item requiring resolution on

project 01-103363 was that the IOR had been replaced by two subsequent IORs, the last of which had not submitted DSA Form-5. The

DSA Form-5, which must be signed by the district, architect, and engineer, must

be filed ten days prior to an IOR beginning a project.

Response: Santa Cruz City

Schools:

See the response to

#46. DSA pulled inspectors from the

project and, since no inspections were required or called for, no Form 5 was

filed.

School Closures/Leasing

48.

In January 2001, the BOC questioned the prudence of

using bond funds to modernize schools that might be closed in the future due to

declining enrollment.

49.

In June 2004, Natural Bridges and Branciforte

Elementary schools closed. Branciforte became a campus for small district

alternative schools. Natural Bridges is leased by Pacific Collegiate, a charter

school that is funded by the state. This site is not being used as part of

Santa Cruz City Schools. Proposition 39 obligates the district to provide a

certain amount of space rent free since sixty percent of the students come from

within SCCS boundaries. Pacific Collegiate leases space for the forty percent

of the students from outside the district. The district also leases space to

another school, Carden El Encanto,

at the former Loma Prieta High School site. Lease funds go into the general

fund. Following is a summary of the current and projected lease income for

these two sites:

|

LEASE REVENUES

|

|

|

04-05

|

05-06

|

06-07

|

07-08

|

08-09

|

|

Natural Bridges

|

$68,000

|

$83,232

|

$84,897

|

$86,595

|

$88,326

|

|

Loma Prieta

|

$140,000

|

$165,000

|

$200,000

|

$228,400

|

$275,500

|

|

|

$208,000

|

$248,232

|

$284,897

|

$314,995

|

$363,826

|

Table 5. Santa Cruz City Schools Lease

Revenues, 2004-2009.

Response: Santa Cruz City Schools PARTIALLY AGREES.

The lease revenue in the table is reversed

for Natural Bridges and Loma Prieta.

50.

In August 2004, a citizen who attended two BOC meetings

expressed concern about bond funds that had been used on schools that were

later closed. The citizen felt that the lease money from those schools should

be used to reduce the bond debt.

Response: Santa Cruz City Schools AGREES.

The BOC discussed the citizen’s

recommendation, but felt that the amount of tax savings to the individual tax

payer would be an insignificant amount, whereas the amount of revenue loss to

the General Fund would be significant.

51.

District administrative staff reported to the BOC

committee that legal counsel said it was not illegal to lease out the renovated

schools and not use the revenues to defray the debt. The BOC approved a motion to not recommend using lease revenues to

retire bond debt.

Response: Santa Cruz City Schools AGREES.

The lease revenue is deposited to the General

Fund to support operating expenses at the schools. Transferring this revenue to reduce Bond debt

would require cuts in school budgets.

District Office Relocation/Renovation

52.

Even after Natural Bridges and Branciforte elementary

schools had been closed, and the four alternative schools on three sites were

moved to the former Branciforte Elementary campus, the district still needed to

reduce overhead and save operating expenses due to declining enrollment. The

district offices on Mission Street were sold, and ten classrooms at Soquel High

School were chosen to serve as administrative offices (Soquel High School’s enrollment dropped from 1693 students in 1998

to 1234 students in 2005-06). The Adult Education Office, the Purchasing

Department, and District Warehouse were moved to Palm Street. The Workability

Program and Food Services Office were moved to DeLaveaga Elementary School.

Response: Santa Cruz City Schools PARTIALLY AGREES.

The sale of 2931 Mission Street and the

relocation of the District office occurred prior to the reorganization of the

schools. The Workability Office was

moved to Harbor High School.

53.

Classrooms identified to house the district offices at

Soquel High had already been remodeled using bond funds. At least an additional

$460,537 in bond money was spent for the district office remodel.

Response: Santa Cruz City Schools AGREES.

The additional cost was to convert

classrooms to office space, to add electrical, a telephone system, data wiring,

and to add parking.

54.

At its April 9, 2003 meeting, the SCCS Board approved

the use of up to $1 million in bond funds for district office relocation and

improvements. In its advisory capacity, the BOC did not recommend this action.

Response: Santa Cruz City Schools AGREES.

55. To